how to calculate pre tax benefits

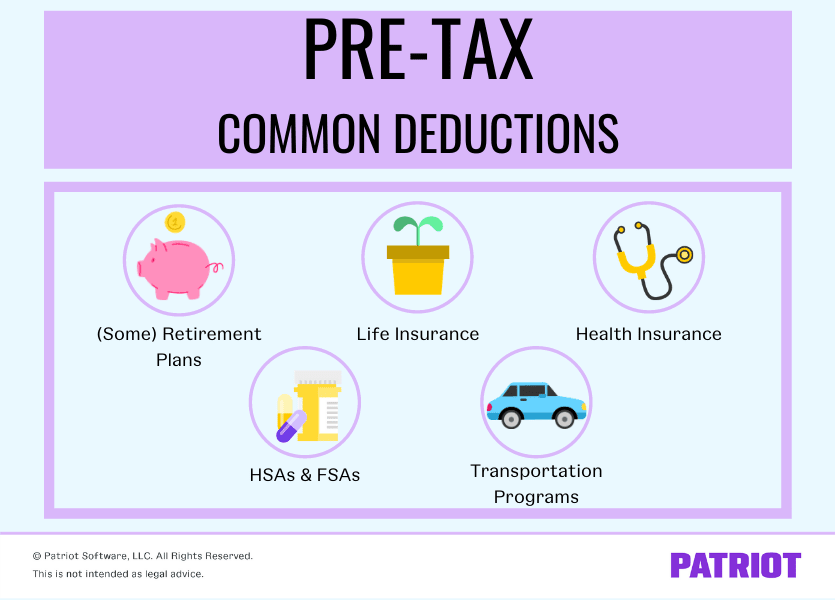

While shopping for health benefits. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes.

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

For example if your biweekly gross.

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and. Depending on your tax. When you enrolled in the plan your employer should have given you the amount which would be deducted from your paychecks.

Earnings before Tax is calculated as Earnings before Tax EBIT Interest Earnings before Tax. Pre-tax Income Gross Revenue Operating Depreciation and Interest Expenses Interest Income What is the pre-tax profit margin. Go online and get a copy of IRS Circular E.

You must include in a recipients pay the amount by which the value of a fringe benefit is more than the sum of the following amounts. 500 total wages taxable by Social Security and Medicare taxes X 0062 employee Social Security tax rate 31 Withhold 31 from Peters wages for the employee. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

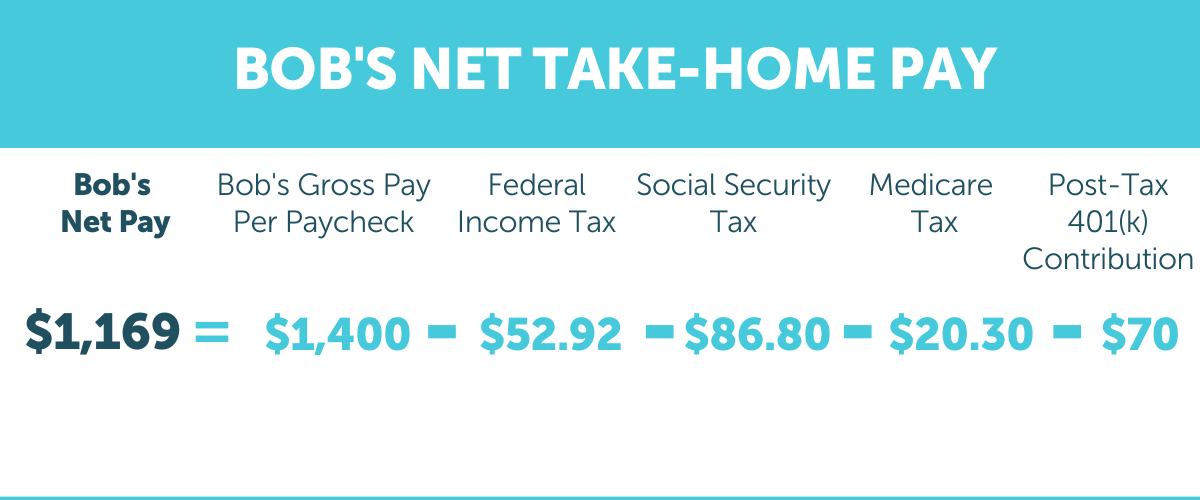

Including taxable benefits in pay. Calculate the employees gross wages Divide Saras annual salary by the number of times shes paid during the year. Say you have an employee with a pre-tax deduction.

And transportation benefits such as parking and transit fees. But thats not always the case. Between 25000 and 34000 you may have to pay income tax on.

Visual of a Pre-tax health benefit account reflecting the 3000 of qualified pre-tax expenses and a corresponding 300 to 1000 in tax savings. You are required to calculate Earnings before tax using the information given below. This is the formula for calculating pre-tax income.

Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans. Any amount the law. Figure federal income tax by retrieving your allowances and filing status respectively from lines 3 and 6 of your W-4 form.

First indicate if you are insuring. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. HSA Tax Savings Calculator This calculator will show you just how much you are saving in taxes by making contributions to a Health Savings Account HSA.

A 401k retirement account is a regular benefit of pre-tax income. Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction. Figure your insurance amount for each pay period.

The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. Take Home Pay Calculator To see how your pre-tax contribution might affect your take home pay enter the following information then click on the Calculate button. Her gross pay for the period is 2000 48000 annual.

Then find the tax. Before taxes you can contribute directly to a 401k from your paycheck.

Pre Tax Vs Roth Contributions What S Best For You Brighton Jones

Pre Tax Income Ebt Formula And Calculator

Form W 2 Explained William Mary

Commuter Tax Benefits Nj Transit New Jersey Transit Corporation New Jersey

What Are Pre Tax Deductions Bamboohr Glossary

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

How To Calculate Taxable Income H R Block

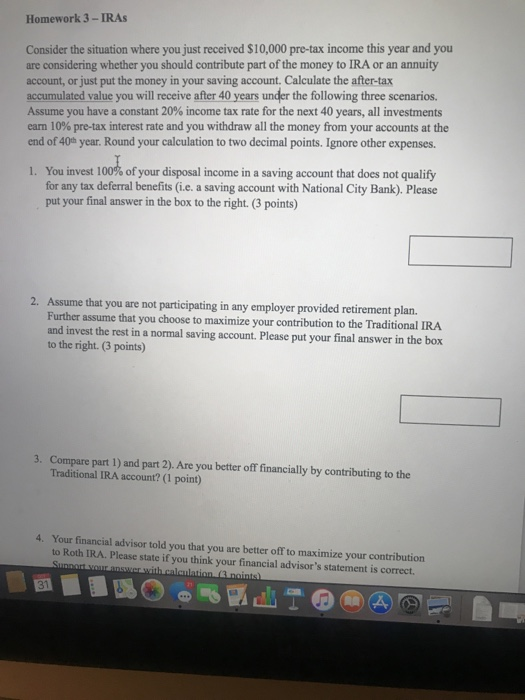

Homework 3 Iras Consider The Situation Where You Just Chegg Com

What Are Pre Tax Deductions Definition List Example

Are Payroll Deductions For Health Insurance Pre Tax Details More

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Calculating Pre Tax Cost Of Equity In Excel Fm

Rsu Taxes Explained 4 Tax Strategies For 2022

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

What Is Taxable Income And How To Calculate It Forbes Advisor

:max_bytes(150000):strip_icc()/After-tax-real-rate-of-return_updated_3-2_Final-ebae62e433754ad69f6274d93275d443.png)